In terms of personal finance, reaching financial freedom requires effective debt management. People are always looking for new and creative ways to get out of debt and move toward financial stability as they make their way through life. Remarkably, one such remedy is found in the domain of regular savings: coupons. In this in-depth tutorial, we explore the transformational potential of coupons and how they can be helpful tools on the path to debt management.

What are Coupons?

Coupons are promotional tools or vouchers that offer discounts, rebates, or other incentives to consumers to encourage them to purchase specific products or services. They typically feature a code or barcode that can be redeemed at the point of sale to receive the advertised discount or benefit.

Coupons can take various forms, including:

- Printed Coupons: Traditionally, coupons were printed on paper and distributed through newspapers, magazines, direct mail, or in-store flyers. Consumers would cut out these paper coupons and present them at the checkout to receive the discount.

- Digital Coupons: With the rise of digital technology, coupons have become increasingly available in digital formats. Digital coupons can be found on websites, mobile apps, email newsletters, and social media platforms. They often feature unique codes or QR codes that can be scanned or entered electronically during online checkout or displayed on a mobile device for in-store redemption.

- Mobile Coupons: Mobile coupons are specifically designed for use on smartphones or other mobile devices. They can be received via text message, mobile apps, or mobile wallet platforms. Mobile coupons offer convenience and flexibility, allowing consumers to access and redeem discounts on the go.

- Print-at-Home Coupons: Some coupons are designed to be printed at home from websites or email promotions. Consumers can print these coupons on their home printers and present them at the store for redemption.

- Load-to-Card Coupons: Many grocery stores and retail chains offer load-to-card coupons, which are digital coupons that can be electronically loaded onto a shopper’s loyalty card or account. The reduction in price is applied automatically during the checkout process when the customer scans their loyalty card or provides their account details.

Coupons are typically issued by manufacturers, retailers, or service providers as part of marketing campaigns to attract customers, promote new products, boost sales, or reward loyal customers. Discounts are widely embraced and efficient methods for customers to economize on their routine expenditures while also enabling businesses to attract more visitors and boost their revenue.

Kinds of Coupons

Here’s a table outlining different kinds of coupons, along with brief descriptions:

| Type of Coupon | Description |

| Printed Coupons | Traditional paper coupons distributed through newspapers, magazines, or direct mail are typically clipped and redeemed in-store. |

| Digital Coupons | Coupons are distributed in digital format, accessible through websites, mobile apps, or email newsletters, for online or in-store use. |

| Mobile Coupons | Coupons are designed explicitly for use on smartphones or mobile devices and are often delivered via text message or mobile apps. |

| Print-at-Home Coupons | Coupons can be printed at home from websites or email promotions and redeemed in-store. |

| Load-to-Card Coupons | Digital coupons are loaded onto a shopper’s loyalty card or account for automatic redemption at checkout. |

| Manufacturer Coupons | Coupons issued by product manufacturers offer discounts on specific brands or products. |

| Store Coupons | Coupons issued by retailers or stores provide discounts on purchases made at specific locations. |

| Online Coupons | Coupons are distributed through e-commerce platforms or retailer websites, offering discounts on online purchases. |

| Loyalty Rewards | Discounts or rewards earned through loyalty programs or memberships are redeemable for future purchases. |

| Cashback Offers | Rebates or cash rewards earned on qualifying purchases are typically deposited into a designated account or platform. |

Understanding the Debt Dilemma

Before we explore the role of coupons in debt management, it’s essential to grasp the gravity of the debt dilemma facing millions worldwide.

From education loans to credit card balances and home mortgages, debt can significantly impede financial advancement and reduce overall well-being. Recent data reveals that the typical American family bears a significant debt load, emphasizing the need to identify lasting remedies swiftly.

The Rise of Couponing Culture

Amidst the quest for financial stability, the emergence of couponing culture has captured the attention of savvy consumers seeking to maximize savings. What began as a modest practice of clipping coupons from newspapers has evolved into a dynamic ecosystem fueled by digital platforms and mobile apps. Today, couponing has transcended its conventional boundaries, offering individuals unparalleled opportunities to save on everyday expenses.

To expand this section, we can delve into the history of couponing, tracing its origins from traditional paper coupons to the digital landscape we see today. We can explore the factors driving the popularity of couponing, such as economic downturns, increased accessibility through technology, and the desire for frugality and financial empowerment.

Harnessing the Power of Coupons

While coupons are commonly associated with grocery shopping and retail purchases, their potential extends far beyond mere discounts. When strategically employed, coupons can serve as valuable assets in debt management strategies. Here’s how:

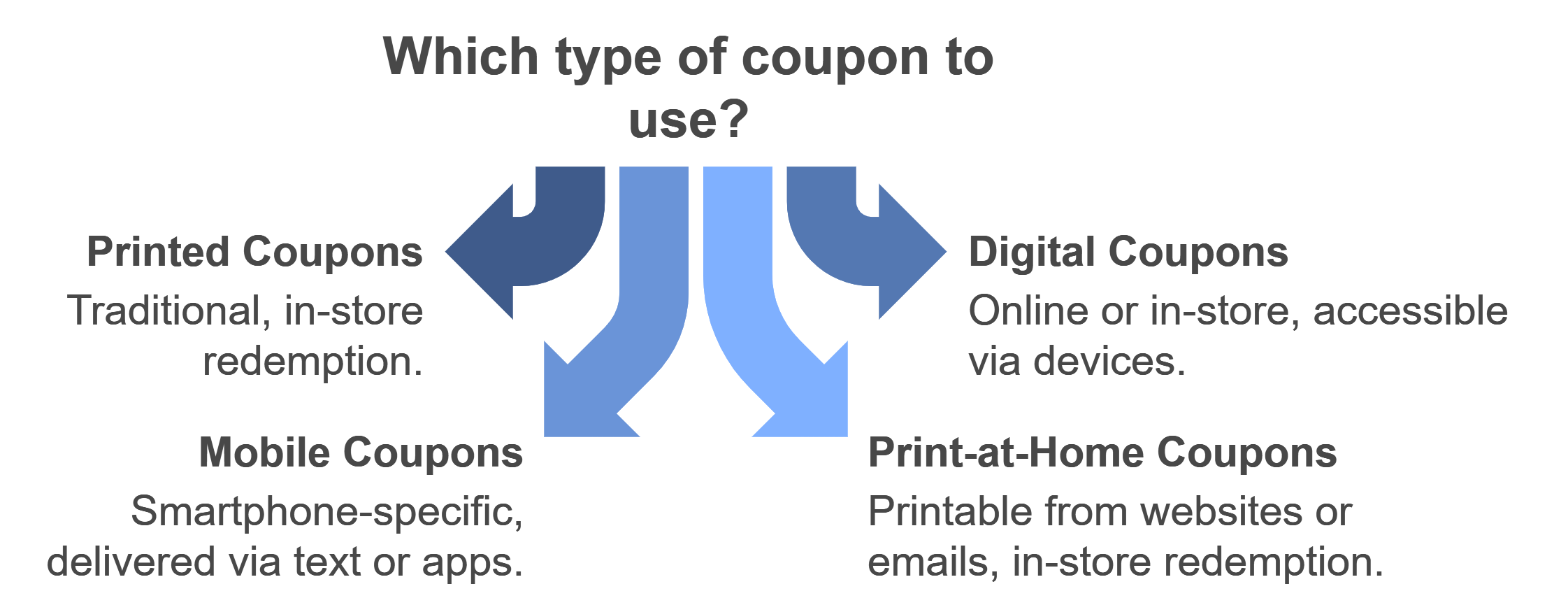

Reducing Expenses

At its core, couponing is about optimizing spending by capitalizing on discounts and promotions. By incorporating coupons into their purchasing habits, individuals can significantly lower their monthly expenses, freeing up additional funds to allocate toward debt repayment. Whether it’s groceries, household essentials, or entertainment expenses, the savings accrued through couponing can make a tangible difference in debt reduction efforts.

To expand this subsection, we can provide examples of everyday expenses where coupons can be utilized, such as groceries, dining out, entertainment, clothing, and household goods. We can also discuss the potential savings that can be achieved through strategic couponing and how these savings contribute to debt reduction goals.

Budget Stretching

For those with debt, maintaining a strict budget is a major challenge. Coupons act as catalysts for budget-stretching, allowing individuals to stretch their dollars further without sacrificing quality or convenience. By leveraging coupons to secure discounts on essential items, individuals can stay within budgetary constraints while still meeting their financial obligations.

Debt Snowball Effect

The debt snowball method, popularized by financial experts, emphasizes the importance of tackling smaller debts first to gain momentum in debt repayment. Coupons play a pivotal role in accelerating the debt snowball effect by amplifying savings on everyday purchases. As individuals consistently apply their couponing strategies and allocate the resultant savings towards debt repayment, they gradually gain traction in their journey toward financial freedom.

To use our Online Debt Snowball Tracker >>> CLICK HERE

Preventing Impulse Spending

Impulse spending is a common pitfall that can derail even the most meticulously crafted budget plans. Coupons serve as a deterrent to impulse spending by incentivizing thoughtful purchasing decisions. Instead of succumbing to spontaneous purchases, individuals are encouraged to prioritize items that offer the most outstanding value through coupon utilization. This mindful approach not only curtails unnecessary expenditures but also fosters disciplined financial habits conducive to debt management.

Building Financial Literacy

Beyond immediate cost savings, couponing fosters a deeper understanding of financial principles and consumer behavior. As people actively search for coupons, compare prices, and assess promotional deals, they acquire crucial financial literacy skills that enable them to make well-informed financial choices. This acquired knowledge forms a basis for enduring financial stability and equips individuals to tackle upcoming financial hurdles confidently.

Navigating the Digital Landscape

In today’s age of digital advancement, couponing has experienced significant changes. With the proliferation of couponing websites, mobile apps, and social media platforms, consumers have unprecedented access to a vast array of money-saving opportunities. By harnessing technology to their advantage, individuals can streamline the couponing process, discover exclusive deals, and stay abreast of promotional campaigns tailored to their preferences.

Various Uses of Coupons

Coupons offer versatile ways for consumers to save money and optimize their spending habits. Here are several diverse uses of coupons:

Grocery Shopping

Coupons are commonly used to save money on groceries, which are essential household expenses. Whether it’s for fresh produce, pantry staples, or household items, coupons provide discounts on a wide range of grocery products. Consumers can clip coupons from newspapers, print them from online sources, or use digital coupons from grocery store apps to lower their grocery bills.

Dining Out

Many restaurants offer coupons and promotional deals to attract customers. These coupons may offer discounts on meals, buy-one-get-one-free (BOGO) offers, or complimentary appetizers or desserts with the purchase of an entrée. By using dining coupons, individuals and families can enjoy meals at restaurants while saving money on their dining expenses.

Online Shopping

E-commerce platforms and retailers often provide coupon codes that customers can apply during online checkout to receive discounts on their purchases. These online coupons may offer percentage discounts, dollar-off savings, free shipping, or other incentives. Online customers can get discounts on a range of goods and services by using a coupon code at the time of checkout.

Retail Purchases

Coupons are frequently used in retail stores to offer discounts on clothing, electronics, home goods, and other merchandise. Retail coupons may be distributed through flyers, catalogs, or email newsletters, and they can provide significant savings on both regular-priced and clearance items. By presenting coupons at the register or entering promo codes online, shoppers can enjoy discounted prices on their retail purchases.

Entertainment

Coupons can be used to save money on entertainment expenses, including movie tickets, live events, theme park admissions, and recreational activities. Entertainment coupons may offer discounts on admission fees, concession purchases, or package deals for multiple attractions. By taking advantage of these coupons, individuals and families can enjoy leisure activities without overspending on entertainment costs.

Travel and Accommodations

Travel coupons can help travelers save money on transportation, accommodations, and other travel-related expenses. Coupons may offer discounts on airline tickets, hotel stays, rental cars, or vacation packages. By seeking out travel deals and using coupons, travelers can reduce the total expense of their trips and vacations.

Health and Wellness

Coupons are also available for health and wellness products and services, such as vitamins, supplements, gym memberships, and spa treatments. These coupons may provide discounts on purchases, free trials, or special promotions. By using these coupons, individuals can prioritize their health and well-being while staying within their budget.

Services

Discount vouchers are available for a range of services, such as car maintenance, house cleaning, pet care, and expert advice. These vouchers might provide price cuts, bundled deals, or special rates for first-time clients. Utilizing these vouchers allows people to access essential services while keeping their costs down.

Coupons offer consumers a multitude of opportunities to save money on everyday purchases, activities, and services. By being resourceful and proactive in seeking out coupons, individuals can maximize their savings and make their money go further. Coupons offer significant savings across various expenses like groceries, dining, online purchases, and travel, aiding individuals in reaching their financial targets and enhancing their general well-being.

Tips on How to Utilize Coupons

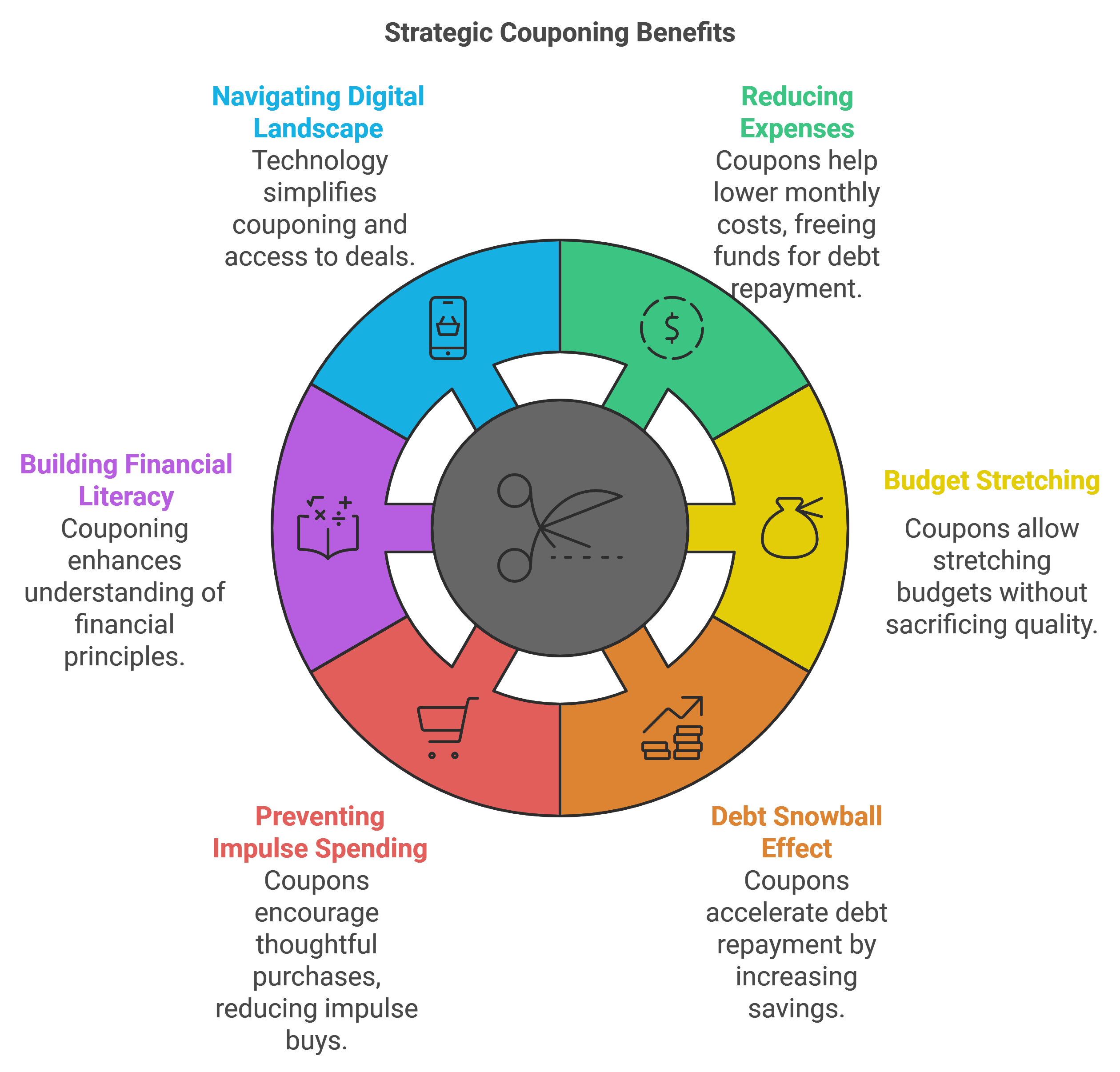

Here are some practical tips on how individuals can utilize coupons to manage or reduce their debt effectively:

- Set Clear Goals: Start by setting clear financial goals, including specific targets for debt reduction. Determine how much debt you want to pay off and by when. Maintaining a clear objective will keep you driven and concentrated on your efforts to pay off your debts.

- Create a Budget: Create a thorough financial plan outlining your income, spending, and existing debts. Identify areas where you can cut costs to allocate more funds to repay debts. Use coupons to reduce the costs of essential purchases, such as groceries, household items, and entertainment.

- Prioritize High-Interest Debt: Eliminate high-interest debt, like outstanding credit card balances, since it can increase and impede your financial advancement. Allocate extra funds to pay off high-interest debt while making minimum payments on other debts.

- Maximize Coupon Savings: To maximize your savings, be proactive in seeking out coupons and promotional deals. Utilize a variety of sources, including newspapers, online coupon websites, mobile apps, and retailer promotions. Search for discounts or vouchers for products you frequently buy to lower your costs for groceries and household items.

- Stack Coupons and Discounts: Take advantage of opportunities to stack coupons and discounts for even more significant savings. Combine manufacturer coupons with store promotions, loyalty rewards, and cashback offers to maximize your savings on purchases. Look for opportunities to double or triple your coupon savings by pairing them with existing discounts.

- Plan Your Purchases: To optimize your savings, plan your purchases around coupon availability and promotional periods.

- To get the greatest discounts, take advantage of seasonal sales, clearance events, and holiday promotions. Consider stocking up on non-perishable items when prices are lowest to maximize your savings over time.

- Track Your Savings: Monitor your progress and stay motivated by tracking your coupon-related savings. Create a system for organizing your coupons and tracking your expenses to ensure you’re maximizing your savings potential. Use couponing apps or spreadsheets to track your savings over time and adjust your strategies as needed.

- Stay Consistent: Consistency is critical to couponing and debt repayment. Incorporate couponing into your regular schedule and maintain dedication to your debt repayment objectives. Acknowledge and rejoice in your achievements as you progress while keeping your sights fixed on the lasting advantages of achieving financial freedom.

Maximizing Couponing Success

While coupons undeniably offer substantial benefits in debt management, maximizing their effectiveness requires a strategic approach. Here are some tips to optimize couponing success:

- Embrace Digital Coupons: Explore the multitude of digital couponing platforms available, including dedicated couponing apps, retailer websites, and cashback portals. By digitizing your couponing efforts, you can access a more comprehensive selection of deals and streamline the redemption process.

- Stack Coupons: Take advantage of coupon stacking opportunities by combining manufacturer coupons with store promotions or loyalty rewards. This synergistic approach allows for maximum savings on eligible purchases, amplifying the impact on debt reduction efforts.

- Timing is Key: Strategically time your purchases to coincide with peak coupon availability and promotional periods. By planning and leveraging seasonal discounts or clearance sales, you can capitalize on optimal savings opportunities.

- Track Savings: Maintain a comprehensive record of your couponing endeavors to track savings over time. By measuring the savings generated from your coupons and keeping track of your progress, you acquire valuable knowledge about how well your couponing methods are working and can make adjustments as needed.

Key Takeaways:

- Coupons as Debt Management Tools: Coupons can be powerful tools for managing and reducing debt by helping individuals save money on everyday expenses.

- Strategic Couponing: Strategic couponing involves planning purchases, maximizing savings opportunities, and allocating coupon-related savings toward debt repayment.

- Budget Optimization: Incorporating coupons into budgeting strategies can stretch your budget further, allowing you to allocate more funds towards debt repayment.

- Debt Snowball Method: Utilizing coupons can accelerate the debt snowball method by increasing cash flow and expediting debt repayment.

- Financial Literacy: Couponing fosters financial literacy by encouraging mindful spending, comparison shopping, and informed financial decision-making.

Frequently Asked Questions (FAQs)

How do coupons help with debt management?

Coupons help with debt management by reducing expenses, stretching budgets, and freeing up additional funds for debt repayment.

What types of expenses can coupons help with?

Coupons can help with a wide range of costs, including groceries, dining out, retail purchases, entertainment, travel, services, and more.

How can I maximize savings with coupons?

To maximize savings with coupons, utilize a variety of sources, stack coupons and discounts, plan purchases around promotions, and track your savings over time.

Can couponing really affect debt repayment?

Yes, couponing can significantly affect debt repayment by increasing cash flow, reducing expenses, and accelerating debt payoff.

Are there any risks or downsides to couponing?

While couponing can offer substantial savings, it’s essential to avoid overspending or purchasing unnecessary items just because you have a coupon. Be mindful of expiration dates, terms and conditions, and any potential fees associated with coupon use.

Additional Resources:

- Coupon Websites and Apps

- RetailMeNot (https://www.retailmenot.com/)

- Coupons.com (https://www.coupons.com/)

- Honey (https://www.joinhoney.com/)

- Rakuten (https://www.rakuten.com/)

- Financial Literacy Resources

- National Endowment for Financial Education (NEFE): https://www.nefe.org/

- MyMoney.gov: https://www.mymoney.gov/

- Consumer Financial Protection Bureau (CFPB): https://www.consumerfinance.gov/

- Debt Repayment Tools and Calculators

- Debt Snowball Calculator: https://www.nerdwallet.com/article/finance/debt-snowball-calculator

- Debt Payoff Planner: https://www.creditkarma.com/calculators/debt-payoff

- Couponing Guides and Articles

- The Krazy Coupon Lady: https://thekrazycouponlady.com/

- Money Crashers – Beginner’s Guide to Coupons: https://www.moneycrashers.com/coupons-for-beginners-guide/

Conclusion

Striving for financial independence involves valuing each saved dollar as a significant stride toward breaking free from the chains of debt. By harnessing the transformative power of coupons, individuals can embark on a pragmatic and empowering journey of debt management. Through strategic couponing practices, budget optimization, and financial literacy cultivation, individuals can chart a course toward a brighter economic future characterized by stability, security, and abundance. Embrace the potential of coupons as catalysts for change and unlock the path to financial freedom today.