Credit card marketing has evolved in the modern world, frequently enticing customers into financial traps that lead to accruing debt. If you’re not careful, it’s easy to fall victim to these strategies with alluring offers and eye-catching promos. However, you can guard against being duped and avoid needless debt by being aware of the tactics used in credit card marketing and taking preventative action. We’ll dive into practical advice and insights in this extensive guide to help you securely traverse the credit card marketing landscape.

What Is a Credit Card?

Banks and other financial organizations provide credit cards as a tool that lets consumers borrow money to pay for products and services. Unlike a debit card linked to a checking account, a credit card allows users to borrow funds up to a specific limit.

When a credit card is used for a transaction, the cardholder takes out a short-term loan from the issuing bank. The cardholder must repay the borrowed amount, along with any applicable interest or fees, within a specified period, usually monthly.

Credit cards provide convenience and flexibility for handling expenses, along with extra perks like rewards programs, cashback incentives, and travel advantages. However, if not used responsibly, credit cards can lead to debt accumulation and financial difficulties due to high-interest rates and fees.

Credit cards can serve as proper financial instruments when managed responsibly. Still, cardholders need to understand their terms and conditions, manage their spending responsibly, and make timely payments to avoid falling into debt.

Credit Card Marketing Tactics

Credit card companies employ various marketing tactics to attract consumers and encourage them to apply for credit cards. These tactics are designed to appeal to consumers’ desires, lifestyles, and financial goals, often leveraging psychological triggers to influence their decision-making. Here are some common credit card marketing tactics:

Sign-Up Bonuses

Offering sign-up bonuses is a prevalent tactic used by credit card companies to incentivize consumers to apply for their cards. Usually, these bonuses consist of cashback incentives, airline miles, or points that are usable for travel, shopping, or as statement credits. The allure of receiving a valuable reward upon approval can persuade consumers to choose one credit card over another.

Introductory APR Offers

Credit card companies often entice consumers with introductory offers of low or zero annual percentage rates (APR) for a limited period. These promotional APRs may apply to purchases, balance transfers, or both. By offering attractive introductory rates, credit card companies aim to attract consumers seeking to save on interest charges or consolidate existing debt.

Reward Programs

Many credit cards feature rewards programs that allow cardholders to earn points, miles, or cashback on their purchases. To appeal to consumer preferences, these rewards can be tailored to specific spending categories, such as groceries, dining, travel, or gas. Credit card companies promote these rewards programs as a way for consumers to earn valuable perks and incentives while using their cards for everyday expenses.

Limited-Time Offers

Creating a sense of urgency is a common tactic in credit card marketing. Credit card companies often introduce limited-time offers, such as increased sign-up bonuses, elevated rewards rates, or exclusive benefits, to encourage consumers to act quickly. By highlighting the time-sensitive nature of these offers, credit card companies aim to prompt consumers to apply for their cards before the opportunity expires.

Targeted Advertising

Credit card companies utilize targeted advertising strategies to reach specific demographics and consumer segments. They may tailor their marketing messages and offers based on age, income, spending habits, and credit history. By delivering personalized advertisements to relevant audiences, credit card companies seek to maximize the effectiveness of their marketing campaigns and attract qualified applicants.

Affiliate Partnerships

Credit card companies often partner with other businesses, such as airlines, hotels, retailers, and financial institutions, to promote their credit cards to a broader audience. These affiliate partnerships may involve co-branded credit cards or special promotions that offer additional benefits or discounts when using the card at partner establishments. By leveraging these partnerships, credit card companies can expand their reach and attract new cardholders through cross-promotion.

Educational Content

Providing educational content is another tactic credit card companies use to engage consumers and build trust. This content may include articles, blog posts, videos, or interactive tools that guide budgeting, credit management, rewards optimization, and fraud prevention. By providing valuable information and resources, credit card companies aim to position themselves as trusted advisors and establish long-term relationships with consumers.

Overall, credit card marketing tactics are diverse and multifaceted, aimed at capturing consumers’ attention, generating interest in their products, and ultimately driving card applications and usage. Although these strategies may draw in customers effectively, it’s crucial for people to thoroughly assess credit card offers, grasp their terms and conditions, and make well-informed choices tailored to their financial objectives and requirements.

| Credit Card Company | Marketing Tactics | Tips for Consumers |

| Chase | We offer lucrative sign-up bonuses, such as bonus points or cashback rewards. | Before applying, ensure you understand the spending requirements to qualify for the sign-up bonus and whether they align with your budget and spending habits. |

| American Express | We provide exclusive benefits like airport lounge access, travel credits, and concierge services. | Evaluate whether the annual fee is justified by the value of the benefits offered and how frequently you’ll use them. |

| Citibank | Promoting balance transfer offers with low introductory APRs to attract customers. | It’s crucial to pay attention to any fees linked to moving balances between credit cards and grasping the duration of the initial period by offering a reduced Annual Percentage Rate (APR).

Consider whether transferring balances will help you save on interest charges. |

| Bank of America | We are collaborating with retail partners to offer co-branded credit cards with rewards tailored to specific consumer preferences. | Analyze the perks and rewards of co-branded credit cards versus traditional ones to identify which aligns better with your spending patterns and preferences.

|

| Capital One | We utilize targeted advertising and personalized offers based on consumer spending habits and credit history. | Review offers carefully to ensure they align with your financial goals and needs. Be wary of offers that seem too good to be true, and always read the fine print. |

| Discover | It provides provides cashback rewards on purchases, with quarterly bonus categories. | Take advantage of cashback rewards by maximizing spending in bonus categories each quarter. Monitor the quarterly calendar to plan your purchases strategically. |

Common Credit Card Traps

Credit cards offer convenience and flexibility but can also present traps that consumers should be aware of to avoid financial pitfalls. Here are some common credit card traps to watch out for:

High-Interest Rates

Credit cards frequently have elevated interest rates, particularly for individuals with subpar credit scores. Maintaining an outstanding balance on your card can swiftly result in accumulating interest fees, presenting difficulty in clearing off debts.

Minimum Payments

Credit card issuers typically require only a monthly payment, which can be a small percentage of the total balance. Although it might appear convenient, paying only the minimum amount prolongs the repayment period for debts and leads to increased interest expenses.

Introductory Offers

Many credit cards lure consumers in with attractive introductory offers, such as low or zero APR for a limited time or sign-up bonuses. While these offers can be enticing, they often come with strings attached, such as high interest rates after the introductory period expires or spending requirements to qualify for bonuses.

Annual Fees

Some credit cards charge annual fees for using them, especially premium or rewards cards that offer exclusive benefits. Before applying for a credit card with a yearly fee, consider whether the benefits outweigh the cost and whether you’ll use them enough to justify the fee.

Hidden Fees

Credit card agreements can be filled with hidden fees and penalties, such as late payment, over-limit, balance transfer, and cash advance fees. Make sure to thoroughly review the details in the fine print to grasp all the possible expenses linked to your card.

Balance Transfer Traps

Balance transfer offers are a lifeline for those struggling with high-interest debt. Still, they often come with transfer fees and temporary low-interest rates that revert to higher rates after a certain period. Additionally, transferring balances can lead to the temptation to accumulate more debt on the original card.

Cash Advances

While credit cards offer the convenience of cash advances, they often come with steep fees and high interest rates. Depending on your credit card for cash advances should be a last resort, as it can quickly lead to accumulating debt if used frequently.

Credit Score Impact

Having multiple credit card accounts open or reaching the maximum limit on your credit cards can have adverse effects on your credit score. This lower score may lead to increased interest rates on loans and mortgages, as well as challenges in securing credit in the future.

By being aware of these common credit card traps, consumers can make informed decisions about their usage and avoid falling into debt traps. It’s essential to read the terms and conditions of credit card agreements carefully, pay attention to fees and interest rates, and use credit cards responsibly to maintain financial health.

Understanding Credit Card Marketing Tactics

Credit card companies employ various tactics to attract consumers, ranging from flashy advertisements to tempting sign-up bonuses. Understanding these tactics is the first step toward protecting yourself from debt traps.

- Beware of Fine Print: Many credit card offers have hidden terms and conditions buried in the fine print. Before signing up for a credit card, carefully review all the details, including interest rates, annual fees, and introductory offers. Pay close attention to the expiration dates of promotional rates to avoid unexpected rate hikes.

- Don’t Be Swayed by Sign-Up Bonuses: While sign-up bonuses may seem lucrative at first glance, they often come with strings attached. Certain credit card issuers may mandate that you meet a specific spending threshold within a designated period to be eligible for the bonus. Before pursuing these offers, evaluate whether the spending requirements align with your budget and spending habits.

- Avoid Impulse Sign-Ups: Credit card marketing campaigns often create a sense of urgency to prompt consumers to sign up quickly. Instead, avoid acting on impulses and dedicate time to thoroughly researching and comparing various credit card choices.

Tips to Avoid Falling into Credit Card Marketing Tactics

Avoiding falling into credit card marketing tactics requires awareness, discipline, and careful consideration of your financial needs and goals. Here are some tips to help you steer clear of credit card marketing traps:

Understand Your Financial Situation

Before you apply for a credit card, it’s crucial to assess your financial situation thoroughly. This involves examining your income, expenses, and any outstanding debts. Determine whether you can afford additional debt and how a new credit card aligns with your financial goals.

Research and Compare Offers

Refrain from being swayed by flashy advertisements or enticing sign-up bonuses. Take the time to research and compare different credit card offers, including interest rates, fees, rewards programs, and benefits. Look for a card that best suits your spending habits and preferences.

Read the Fine Print

Thoroughly examine the terms and conditions of credit card offers, focusing on interest rates, annual fees, late payment charges, and additional fees. Be wary of hidden fees and restrictions buried in the fine print, and ask questions if anything is unclear.

Consider Your Spending Habits

It’s crucial to choose a credit card that fits your spending habits and way of life. For instance, opting for a travel rewards credit card can be advantageous if you often travel. These cards typically provide benefits like airline miles or discounts on hotel bookings, enhancing your travel experience. If you prefer simplicity, a cashback credit card may be more suitable.

Avoid Impulse Decisions

Refrain from succumbing to pressure or urgency when applying for a credit card. It’s crucial to thoroughly analyze both the pros and cons of a choice and determine if the advantages outweigh the disadvantages. Rushing into choices without thoughtful consideration can result in regrets or financial difficulties down the line.

Set a Credit Limit

Establish a credit limit for yourself based on your budget and financial goals. It’s best to avoid maxing out your credit cards or maintaining high balances, as doing so could harm your credit score and raise the likelihood of accumulating debt.

Pay Your Balance in Full

Whenever you can, make sure to settle your credit card balance entirely every month to steer clear of accumulating interest fees, if paying the entire balance is not feasible, pay more than the minimum to reduce interest costs and pay off your balance faster.

Monitor Your Spending

It’s important to stay vigilant about your credit card activity by regularly monitoring your transactions and keeping tabs on your spending habits. Review your credit card statements carefully to identify any unauthorized or fraudulent charges. You can detect potential issues early and appropriately address them by staying vigilant.

Be Skeptical of Promotional Offers

Approach promotional offers cautiously, especially those that seem too good to be true. Take your time to thoroughly examine the terms and conditions and think about the possible future outcomes before accepting any offer.

Seek Financial Advice if Needed

If you need help deciding which credit card to select or how to handle your finances wisely, it’s advisable to consult a financial advisor or credit counselor. These professionals offer tailored advice and assist you in making well-informed choices that suit your situation.

Strategies to Avoid Debt

Preventing debt requires a proactive approach and disciplined financial habits. Implementing the following strategies can safeguard against unnecessary debt and financial strain.

- Set a Budget: A budget is essential for responsibly managing your finances. Calculate your monthly earnings and designate certain portions for necessary expenditures, saving goals, and discretionary purchases. Stick to your budget diligently to avoid overspending and accumulating debt.

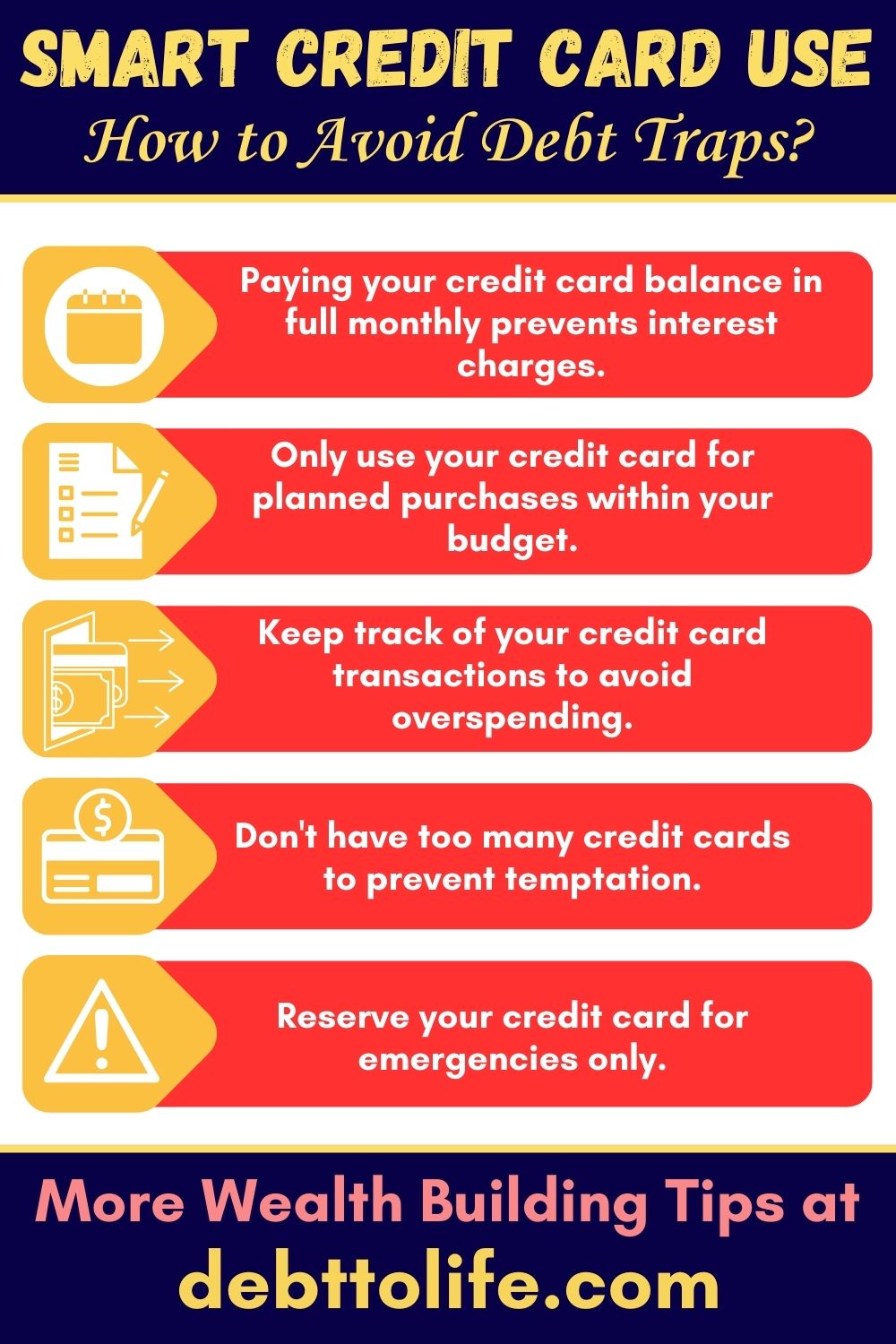

- Pay Your Balance in Full: One effective method to avoid getting into debt is to make sure you completely pay off the balance on your credit card every month. By settling the entire balance, you prevent interest fees from accumulating and retain authority over your financial situation. If paying the whole balance is not feasible, strive to pay more than the minimum due to reduced interest costs.

- Monitor Your Credit Card Statements: It’s important to consistently check your statements to keep track of your spending and spot any unauthorized or suspicious charges. Keeping an eye on your statements helps you catch any discrepancies early on and take the necessary steps to address them. If you notice anything unusual, report it to your credit card issuer immediately to prevent any additional financial damage.

Snowball Method in Paying Debt

The snowball method is an approach to paying off debt where you focus on clearing smaller balances first, regardless of the interest rates attached to each debt. Here’s how it works:

- List Your Debts: Begin by compiling a detailed list of all your financial obligations, encompassing credit card debts, outstanding loans, and any other amounts owed. Arrange them in order from smallest to most significant balance.

- Make Minimum Payments: Make sure you meet the minimum payment requirements for all your debts, excluding the ones with the smallest balances. Concentrate on allocating most of your available funds towards paying off the smallest debt while ensuring you make minimum payments on the others.

- Pay Off Smallest Debt: Focus on aggressively paying off the smallest debt first. Devote any extra funds toward this debt, such as bonuses, tax refunds, or additional income. After clearing the debt with the lowest balance, tackle the next debt with the smallest amount owed on your list.

- Build Momentum: As you pay off each debt, you’ll experience a sense of accomplishment and momentum, like a snowball rolling downhill and gaining size. This psychological boost can motivate you to continue paying off your debts.

- Repeat the Process: Continue applying the snowball method to your remaining debts, working your way up from smallest to largest. As you eliminate each debt, allocate the money you were paying toward it to the next debt on your list.

The snowball method is effective because it provides a straightforward, manageable approach to debt repayment and offers quick wins. While the avalanche method, which pays off debts with the highest interest rates first, may save more interest than other strategies, the snowball method has special benefits for those who need encouragement and support to meet their debt repayment goals.

Ultimately, consistency and discipline are the key to successfully using the snowball method. Remaining dedicated to achieving freedom from debt and adhering to the principles of the snowball method allows you to advance steadily toward financial independence.

Key Takeaways:

- Credit Card Marketing Tactics: Credit card companies use various marketing tactics to attract consumers, including sign-up bonuses, rewards programs, and limited-time offers. Recognizing these strategies can empower consumers to make well-informed choices when applying for credit cards.

- Avoiding Credit Card Traps: Common credit card traps include high interest rates, minimum payments, annual fees, hidden fees, and balance transfer offers. Awareness of these traps can help consumers avoid debt and financial difficulties.

- Responsible Credit Card Usage: Responsible credit card usage involves setting a budget, monitoring spending, paying off balances in full each month, and avoiding impulse purchases. Using credit cards responsibly, consumers can build a positive credit history and avoid unnecessary debt.

FAQs

What are some common credit card marketing tactics?

Standard credit card marketing tactics include sign-up bonuses, rewards programs, and limited-time offers designed to attract consumers.

How can I avoid falling into credit card traps?

To avoid credit card traps, consumers should be aware of high-interest rates, minimum payments, annual fees, hidden fees, and balance transfer offers. Responsible credit card usage involves setting a budget, monitoring spending, and paying off balances monthly.

How can one effectively utilize credit cards while being responsible?

Tips for responsible credit card usage include setting a budget, monitoring spending, paying off balances in full each month, and avoiding impulse purchases. By using credit cards responsibly, consumers can avoid unnecessary debt and build a positive credit history.

Additional Resources:

- Federal Trade Commission (FTC): The Federal Trade Commission (FTC) offers guidance to consumers regarding credit cards, offering advice on how to use them responsibly and steer clear of credit card scams. (Website: www.ftc.gov)

- Consumer Financial Protection Bureau (CFPB): Credit card agreements, fees, and transparency are covered by resources and information offered by the Consumer Financial Protection Bureau (CFPB). These resources aim to empower consumers with knowledge, enabling them to make well-informed decisions regarding credit cards. (Website: www.consumerfinance.gov)

- Credit Karma: Credit Karma provides free credit scores, credit reports, and personalized recommendations for credit cards based on individual financial profiles. (Website: www.creditkarma.com)

- NerdWallet: NerdWallet offers expert reviews, comparison tools, and financial advice to help consumers choose the right credit cards for their needs. (Website: www.nerdwallet.com)

Conclusion

Navigating the world of credit card marketing requires vigilance and informed decision-making. By understanding the tactics employed by credit card companies and implementing proactive strategies to avoid debt, you can protect yourself from being fooled by deceptive marketing practices. Remember the importance of being financially responsible and making well-informed decisions that align with your future financial objectives. With the right mindset and approach, you can stay one step ahead of credit card marketing traps and achieve financial peace of mind.